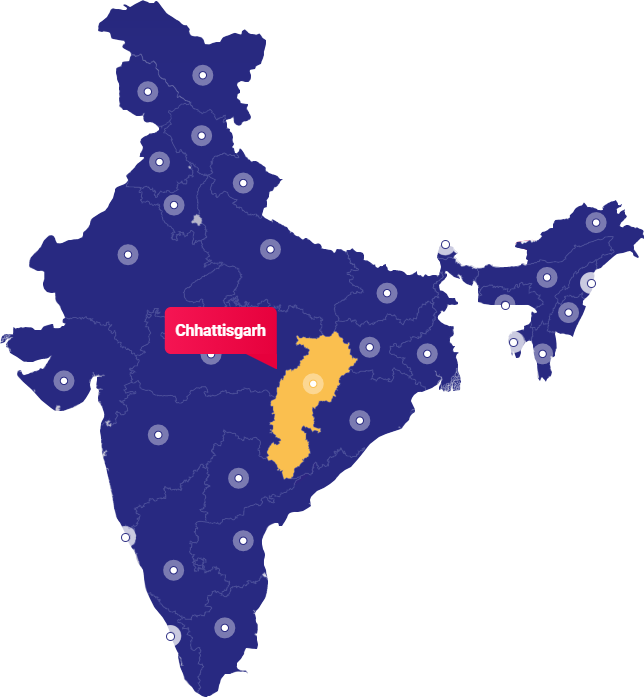

Chhattisgarh is an emerging State with unmatched potential and limitless opportunities. The State accounts for 15% of the total steel produced in the Country. It has one of the highest mineral reserves in the Country. With 44% of the State’s land under forests, Chhattisgarh accounts for 12% of India’s forests. Identified as one of the richest biodiversity habitats, the State of Chhattisgarh has some of the most dense forests in India with a rich wildlife and over 200 non-timber forest products, which offer a tremendous potential for value addition.

Though strong core sector industries such as iron, steel, cement, and thermal power have traditionally imparted a high growth thrust, the State has identified Food Processing Sector as a sunrise sector for upcoming infrastructure development. Business friendly policies and a proactive administration make Chhattisgarh a preferred investment destination.

1st in production of Bitter gourd; 3rd in production of Pointed gourd; among the top 5 states in production of Pumpkin and Bottle gourd.

Among the top 10 States in Fish Seed and Inland Fish Production

627 dairy cooperatives in the state and the milk production is expected to reach by 2020

Egg Production during 2018-2019.

| District Name | Company Name | Status | Contact Details | Investment Leverage (Rs. in Cr.) | Direct Employement Granted (in Nos.) | Farmers Benefited (in Nos.) | Processing Capacity (LMT) PA | Preservation Capacity (LMT) PA |

|---|---|---|---|---|---|---|---|---|

| RAIPUR | *Indus Best Mega Food Park Private Limted | Completed | Sultan Email: mail[at]ibgroup.co[dot]in Mobile: 9350455555 |

52.6200 | NA | NA | 0.4200 | 0.8400 |

| District Name | Company Name | Status | Contact Details | Investment Leverage (Rs. in Cr.) | Direct Employement Granted (in Nos.) | Farmers Benefited (in Nos.) | Processing Capacity (LMT) PA | Preservation Capacity (LMT) PA |

|---|---|---|---|---|---|---|---|---|

| BEMETARA | Varda Energy and Engineering Private limited | Ongoing | Shri Radheshyam Agarwal Email: NA Mobile: NA |

26.0200 | 270 | 4000 | 0.0960 | 0.0750 |

| RAJNANDGAON | Kripal Agro Park Pvt Ltd | Ongoing | Kripal Agro Park Pvt. Ltd. Email: kripal.agropark[at]yahoo[dot]com Mobile: 8224811111 |

25.8435 | 240 | 4000 | 0.0120 | 0.0500 |

| District Name | Company Name | Status | Contact Details | Investment Leverage (Rs. in Cr.) | Direct Employement Granted (in Nos.) | Farmers Benefited (in Nos.) | Processing Capacity (LMT) PA | Preservation Capacity (LMT) PA |

|---|---|---|---|---|---|---|---|---|

| RAIPUR | Utsav organic & cold chain | Completed | Mr.Kabir Sibbal Email: coldchainutsav[at]gmail[dot]com Mobile: 9826208000 |

14.6300 | 100 | 9552 | 0.0000 | 0.1500 |

| RAIPUR | L.l. logistics pvt. ltd | Completed | Mr.Anoop Agrawal Email: anupgd[at]gmail[dot]com Mobile: 9425202681 |

11.3400 | 100 | 9552 | 0.0000 | 0.1100 |

| Warehouse Name | Name and Address | Mobile | Capacity (MT) |

|---|---|---|---|

| Central Warehousing Corporation | Bilaspur-I,Deorikund Near Housing Board Colony, , Distt-Bilaspur | 9757169304 | 28000 |

| Central Warehousing Corporation | Bilaspur-II,Industrial area Tifra, , Distt- Bilaspur | 9757169304 | 38350 |

| Central Warehousing Corporation | Raipur-II,Fokatpara Mandi Unit Raipur, , Distt-Raipur | 9757169304 | 8800 |

| Central Warehousing Corporation | Raipur-III,Near Urkura Railway Station Bhanpuri industrial area,P O Birgaon , Distt- Raipur | 9757169304 | 33200 |

| Central Warehousing Corporation | Raipur-I,Fokatpara Raipur, , Distt-Raipur | 9757169304 | 13000 |

| Central Warehousing Corporation | Raipur-IV,Rawabhanta Raipur, , Distt- Raipur | 9757169304 | 20000 |

| Central Warehousing Corporation | Raigarh-I,Kabir chowk Orrisa Road, , Distt- Raigarh | 9757169304 | 11300 |

| Central Warehousing Corporation | Raigarh-II,Odhisha Road Garh Umariya, , Distt-Raigarh | 9757169304 | 32000 |

| Central Warehousing Corporation | Bhatapara-II,Surkhi Road Bhatapara, , Distt- Surguja | 9757169304 | 28900 |

| Central Warehousing Corporation | Dhamtari,Majratola Ward no. 18, Bhatgaon - Soram Road, Dhamtari, , Distt- Dhamtari | 9757169304 | 10000 |

| S. No. | District | ODOP |

|---|---|---|

| 1. | Balod | Ginger Based products |

| 2. | Baloda Bazar-Bhatapara | Rice Based Products |

| 3. | Balrampur | Groundnut based products |

| 4. | Bemetara | Papaya based products |

| 5. | Bilaspur | Fish based products |

| 6. | Dantewada (South Bastar) | Mango |

| 7. | Dhamtari | Rice Based Products |

| 8. | Durg | Tomato based products |

| 9. | Gurela-Pendra-Marwahi | Custard Apple based Products |

| 10. | Jagdalpur (Bastar) | Tamarind based products |

| 11. | Janjgir-Champa | Rice based products |

| 12. | Jashpur | Tea |

| 13. | Kabirdham (Kawardha) | Jaggery |

| 14. | Kanker (North Bastar) | Custard Apple based products |

| 15. | Kondagaon | Cashew based Products |

| 16. | Korea (Koriya) | Tomato based products |

| 17. | Mahasamund | Milk based products |

| 18. | Mungeli | Tomato based products |

| 19. | Raigarh | Tomato based products |

| 20. | Raipur | Jam, Jelly |

| 21. | Rajnandgaon | Rice Based Products |

| 22. | Sukma | Jowar, Kodo-kutki based products |

| 23. | Surajpur | Turmeric based products |

| 24. | Surguja | Litchi Products |

| Policy & Incentives | Description | ||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name of Policy |

|

||||||||||||||||||||||||||||||||||||||||||

| Nodal Agency |

|

||||||||||||||||||||||||||||||||||||||||||

| Single Window Clearance System |

|

||||||||||||||||||||||||||||||||||||||||||

| Power/Electricity Subsidy |

|

||||||||||||||||||||||||||||||||||||||||||

| Capital Subsidy | Fixed capital investment subsidy for eligible Micro industries established by entrepreneurs of general category will be as details given below

|

||||||||||||||||||||||||||||||||||||||||||

| Interest Subsidy | Interest subsidy for eligible industries established by entrepreneurs of general category on term loan will be as given below

|

||||||||||||||||||||||||||||||||||||||||||

| VAT/CST/SGST/TAX Exemption/Reimbursement |

|

||||||||||||||||||||||||||||||||||||||||||

| Employment Generation | Not Applicable |

||||||||||||||||||||||||||||||||||||||||||

| Freight/Transport Subsidy | Transport subsidy for export of products will be eligible for the maximum amount of INR 20 lakh per annum for a maximum period of 5 years |

||||||||||||||||||||||||||||||||||||||||||

| Others | Incentives to promote women entrepreneurs in Food ProcessingIndustries set up by women entrepreneurs, will get 10% additional incentives and the ceiling of incentives will be increased by 10%, while in the terms of time limit one year more, in addition to the incentives enumerated in clause 15.1 of Industrial Policy 2019-24 for the general category entrepreneurs. Exemption from mandi feesAll the New micro, small, medium and large agricultural and food products processing industries to be established in the State will get full exemption from mandi tax imposed on agricultural products (except ineligible industries mentioned in Annexure-4) for 5 years from the date of first purchase of raw materials from the state mandis / direct producing farmers / units / outside the state with maximum limit of Rs. 2.00 Crore per year. Also, the total exemption limit will not exceed 75% of the Fixed capital investment made by the unit. Micro, Small & Medium enterprises will be eligible for land premium subsidy on the allotment of land from Industrial area/ parks

Incentive for setting up food parkTo promote development of new private Industrial Areas/Parks with minimum 25 Acres of land, subsidy of 30% of the infrastructure cost (Excluding Land) with a ceiling of Rs. 5 Crore and 100% exemption in Stamp Duty, 100% exemption in land registration cost and 100% exemption in Diversion Fee will be given. The industrial unit/s which will be set up in these new private industrial areas/parks will be entitled for industrial investment incentives. Additional Subsidy / Scheme pertaining to the state

|

||||||||||||||||||||||||||||||||||||||||||

Connect with us for any Investment Related Query

+91 92 0548 0590