| District Name | Company Name | Status | Contact Details | Investment Leverage (Rs. in Cr.) | Direct Employement Granted (in Nos.) | Farmers Benefited (in Nos.) | Processing Capacity (LMT) PA | Preservation Capacity (LMT) PA |

|---|---|---|---|---|---|---|---|---|

| Record not available. | ||||||||

| District Name | Company Name | Status | Contact Details | Investment Leverage (Rs. in Cr.) | Direct Employement Granted (in Nos.) | Farmers Benefited (in Nos.) | Processing Capacity (LMT) PA | Preservation Capacity (LMT) PA |

|---|---|---|---|---|---|---|---|---|

| Record not available. | ||||||||

| District Name | Company Name | Status | Contact Details | Investment Leverage (Rs. in Cr.) | Direct Employement Granted (in Nos.) | Farmers Benefited (in Nos.) | Processing Capacity (LMT) PA | Preservation Capacity (LMT) PA |

|---|---|---|---|---|---|---|---|---|

| Record not available. | ||||||||

| Warehouse Name | Name and Address | Mobile | Capacity (MT) | |||||

|---|---|---|---|---|---|---|---|---|

| Record not available. | ||||||||

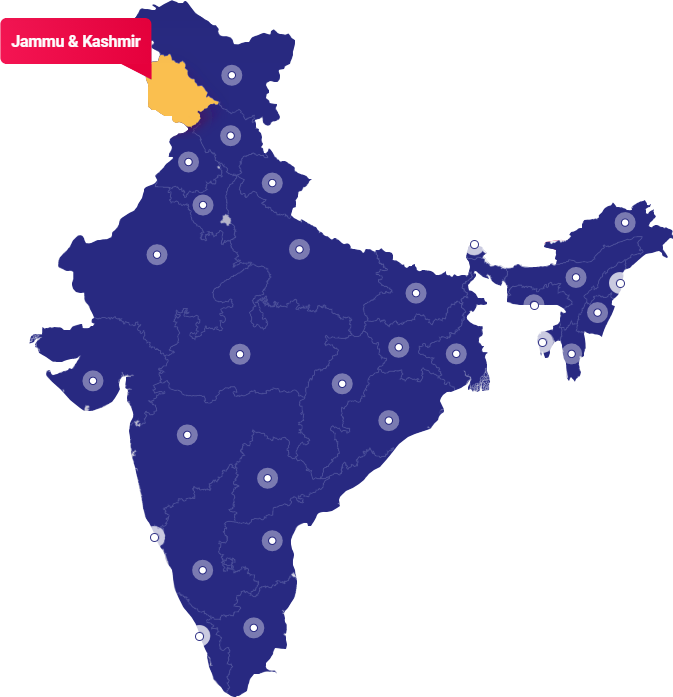

| S. No. | District | ODOP |

|---|---|---|

| 1. | Anantnag | Fish based products |

| 2. | Bandipora | Processed poultry/ mutton products |

| 3. | Baramulla | Apple |

| 4. | Budgam | Dairy Products |

| 5. | Doda | Olive Products |

| 6. | Ganderbal | Fish based products |

| 7. | Jammu | Dairy Products |

| 8. | Kathua | Spices |

| 9. | Kishtwar | Walnut products |

| 10. | Kupwara | Walnut products |

| 11. | Kulgam | Spices and Pickle |

| 12. | Poonch | Millet based products |

| 13. | Pulwama | Saffron |

| 14. | Rajouri | Dairy Products |

| 15. | Ramban | Honey |

| 16. | Reasi | Spices |

| 17. | Samba | Mushroom Products |

| 18. | Shopian | Apple |

| 19. | Srinagar | Packed Bakery Products |

| 20. | Udhampur | Pickles |

| Policy & Incentives | Description | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name of Policy |

|

||||||||||||||||||||||||

| Nodal Agency |

|

||||||||||||||||||||||||

| Single Window Clearance System | Single window clearance http://www.investjk.in/ |

||||||||||||||||||||||||

| Power/Electricity Subsidy |

|

||||||||||||||||||||||||

| Capital Subsidy |

|

||||||||||||||||||||||||

| Interest Subsidy |

Interest Subvention |

||||||||||||||||||||||||

| VAT/CST/SGST/TAX Exemption/Reimbursement |

|

||||||||||||||||||||||||

| Employment Generation |

|

||||||||||||||||||||||||

| Freight/Transport Subsidy |

|

||||||||||||||||||||||||

| Others |

Incentive to Farmer Producer Organizations (FPOs) Agro/ Food Cooperatives. |

Connect with us for any Investment Related Query

+91 92 0548 0590